Dedicated to applying artificial intelligence technology in the field of financial investment.

StocksQuant

Qtaiilab is an AI-driven platform for quantitative investment, leveraging AI to enhance research and create value from concept to production.

QTAII DeepLearn Library

- Free to use

- Open Source

- Less Code

- Sample Structure

- Various algorithms

- Backtesting

| Comparison | QTAII | Qlib |

| Factors Mining | Support | NO Support |

| code volume | Less | More |

| program structure | Simple, divided into three parts: 1 Data Download and Modification 2 Input into Deep Learning 3 Historical Backtesting | Highly complex with multiple frameworks, hard to understand. |

| code modification | Very simple | A slight move in one part can affect the whole situation |

| Difficulty level | Get Started in 10 Minutes | Several weeks to several months |

| Supported investment products | All,just needed is to generate the data for each product (such as cryptocurrencies) in the same format | Exceptionally difficult, with constant errors |

| Algorithms | Almost to Qlib | A little more than QTAII |

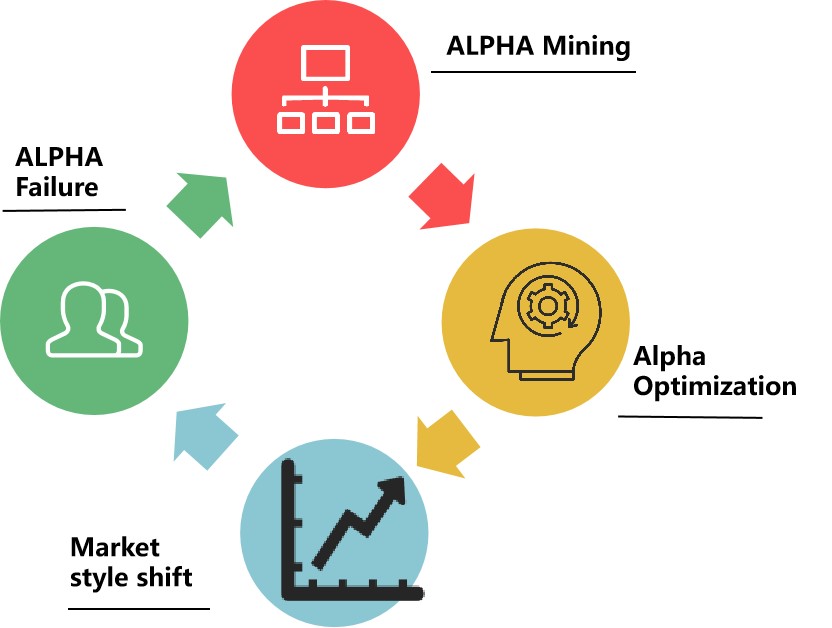

Alpha Mining

Search excess returns factors input to your models.

Deep Learn

More than a dozen deep learning algorithms and models.

Backtesting

Taking a time machine to check how well your model would do.

Free

Free stocks history price data and models.

Open Source

Low-code development and simple architecture, easy to modify.

Not just stocks

Input any data and get a result, e.g., futures and cryptocurrencies.

Quant Factor Mining

Factor mining is a financial data analysis method aimed at identifying the key factors that influence asset prices from a large amount of data.

charge $9.98/month

- Seek alpha factors

- Multi-threaded mining

- Factor screening

- Factor analysis

- Long and hedging factor mining

- Supporting stocks, futures, crypto and more

| QTAII Library | FREE | $9.98/month |

| Factors Mining | NO Support | Support |

| Data | Support | Support |

| Algorithms | Support | Support |

| example | Support | Support |

| Factor screening | Support | Support |

| Factor analysis | Support | Support |

Alpha Mining

Search excess returns factors input to your models.

Deep Learn

More than a dozen deep learning algorithms and models.

Backtesting

Taking a time machine to check how well your model would do.

Free

Free stocks history price data and models.

Open Source

Low-code development and simple architecture, easy to modify.

Not just stocks

Input any data and get a result, e.g., futures and cryptocurrencies.

AI Options Strategist

If an investor has enough data and a sufficiently powerful computer, they can evaluate a vast number of strategies every day and select the best positions based on expected returns.

Realtime Data

- Historical Data

- Realtime Quote

- More News

- Stocks and Options API

- Calculated by bid and ask

- Data fees $9 per month

- One month free

| AI Options Strategist | FREE | $9.99/month |

| AI Option Strategies | Parts | ALL |

| Data fees | $9/month | $9/month |

| Monte Carlo | Support | Support |

| Strategies Payoff Diagram | Support | Support |

| Quotes | Support | Support |

| Volatility and Skewness | Support | Support |

| News | Support | Support |

AI Options Strategist

Search the best options strategy through AI.

Strategies builder

A tool that allows traders to create, analyze, and visualize various options trading strategies.

Monte Carlo

It estimates the value and risk of options by simulating numerous random paths.

Historical Volatility

It measures how much a stock’s price has fluctuated over a specified period.

Skewness

Measures the asymmetry of the returns distribution of an asset.

Free to use

Free Options quote,stock headline and all