QTAII DeepLearn Library

QTAII is an AI-driven quantitative investment platform designed to harness the potential of artificial intelligence technology, support research, and create value from concept exploration to production implementation. QTAII supports various machine learning paradigms, including supervised learning, market dynamics modeling, and reinforcement learning. Increasingly, cutting-edge quantitative research and papers on different paradigms are being published on QTAII, aiming to collectively address key challenges in quantitative investing.

Quant Factors Mining

Factor mining is a financial data analysis method aimed at identifying the key factors that influence asset prices from a large amount of data. These factors can include market sentiment, company fundamental data, macroeconomic indicators, and more. By redefining, evaluating, and combining these factors, financial engineers can create high-return investment portfolios.

DeepLearn

Deep learning has shown significant progress in quantitative stock analysis. By analyzing a vast amount of historical data and market trends, deep learning models can predict stock price fluctuations, helping investors make more informed decisions.

- The lab offers more than a dozen deep learning algorithms, including: addrnn, ADD, alstm, den, gats, gru, igmtf, krnn, localformer, lstm, sandwich, tabnet, tcn, tcts, and transformer. The algorithms are continuously updated.

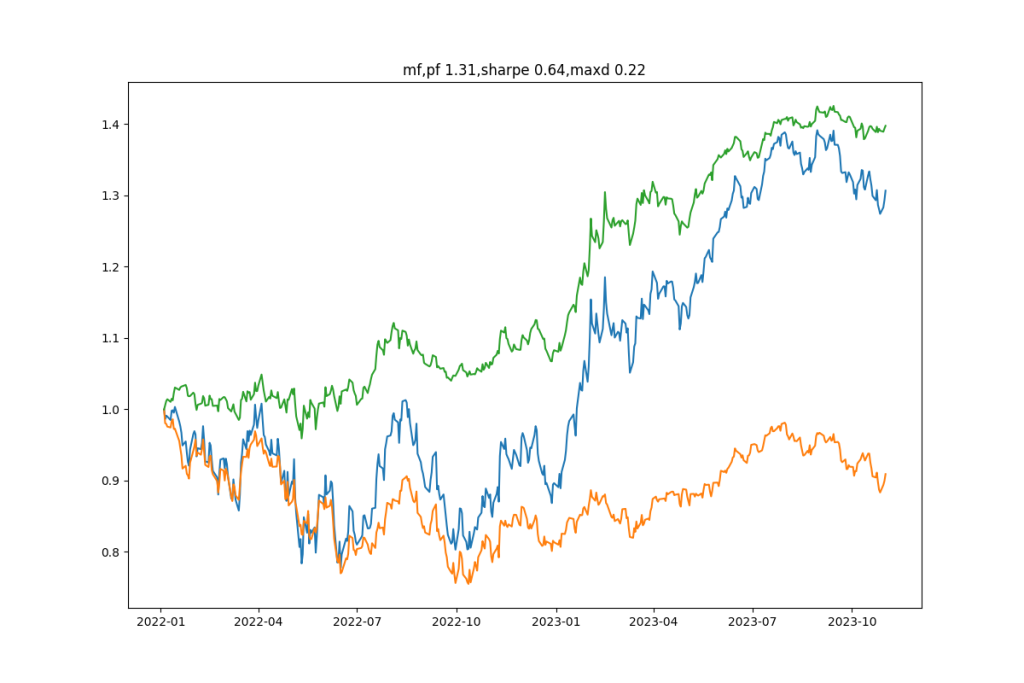

Backtesting

Backtesting is a crucial part of validating any quantitative strategy. It involves testing a trading strategy on historical data to see how it would have performed. Essentially, it’s like taking a time machine to check how well your model would do if you had used it in the past.

In our deep learning strategy, once we have generated signals based on our trained model, we can run these signals through historical data to see the returns and risks associated with the strategy. This helps in fine-tuning the model and making necessary adjustments to improve its performance before applying it to live trading.