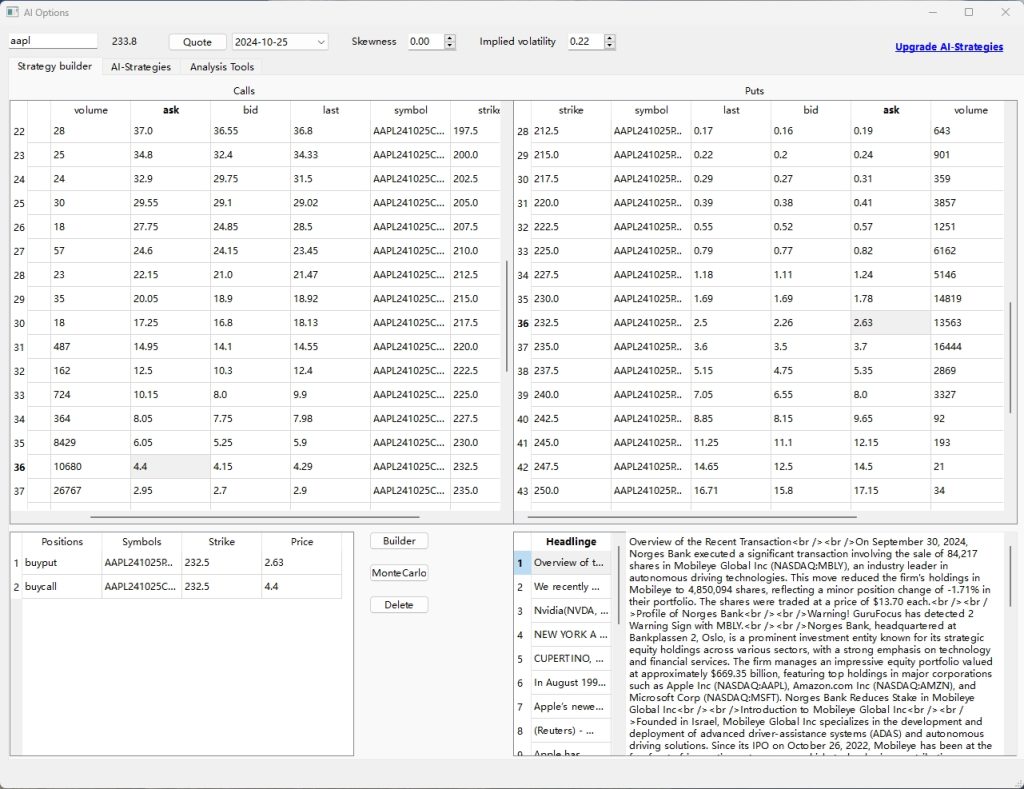

Core Features:AI Options Strategist

Through massive data and powerful AI computing, we can evaluate a large number of option strategy portfolios daily and select the optimal positions based on expected returns. The strategies might involve buying some options (puts or calls), some bull call spreads, some naked puts and ratio calendar spreads, some straddle sales and ratio writes, as well as covered call writes.

Strategies are ranked according to their expected return or probability of profit, and the best trades are identified based on target prices and dates. AI provides real-time calculations, effectively evaluating the entire options market and ranking daily opportunities.”

Options Strategy builder

An option strategy generator is a tool that allows traders to create, analyze, and visualize various option trading strategies. It includes:

- Interactive Charts: Many tools offer interactive charts to visualize strategies along with real-time option prices, Greeks, and volatility.

- Strategy Creation: Users can select different options (calls and puts), expiration dates, and strike prices to build custom strategies.

- Profit and Loss Calculation: The tool calculates the expected profit and loss for each strategy, helping traders understand potential outcomes.

- Risk Profile Visualization: It visualizes the risk profiles of standard strategies such as naked options, vertical spreads, straddles, etc. This helps in assessing the risks associated with each strategy.

This tool is designed to provide traders with comprehensive insights into their option trading strategies, enabling them to make informed decisions.

Monte Carlo

Simulate Stock Prices: Use random variables to generate future stock price paths. Each path represents a possible price scenario based on the current stock price, expected return, and volatility.

Calculate Option Payoffs: For each simulated price path, calculate the payoff of the option at expiration. For example, for a European call option, if the stock price is higher than the strike price, the payoff is the difference between the stock price and the strike price; otherwise, it is zero.

Calculate Risk Metrics: Monte Carlo simulations can also compute risk metrics such as Value at Risk (VaR) and Conditional Value at Risk (CVaR) to aid in risk management.

Monte Carlo simulation provides a powerful and versatile tool for option pricing.

Historical Volatility

Historical volatility plays a crucial role in options trading. It measures the degree of fluctuation in a stock’s price over a specific period. While historical volatility cannot perfectly predict the future, it provides a reference point for forecasting potential future price movements. Option prices are significantly influenced by volatility. Higher volatility implies higher risk, which usually results in higher option premiums. Traders use historical volatility to set risk management strategies, such as determining stop-loss and take-profit levels.

Ultimately, historical volatility helps traders assess potential risks and make informed decisions about their options trades.”nformed decisions about option trades.

Skewness

Skewness measures the asymmetry of the returns distribution of an asset. In options trading, understanding skewness is essential for several reasons:

- Pricing: Skewness affects the pricing of options. A positive skew indicates that there’s a higher probability of significant positive returns, making out-of-the-money calls more expensive. Conversely, a negative skew signals higher chances of substantial negative returns, affecting put prices.

- Risk Management: Traders use skewness to assess risk and decide on appropriate hedging strategies. Negative skew implies a higher risk of sharp declines, which might necessitate different hedging than a positively skewed asset.

- Market Sentiment: Skewness helps gauge market sentiment. For example, a heavily negative skew might suggest that investors are more concerned about potential downturns, while a positive skew could imply bullish expectations.

- Volatility Skew/Smile: Skewness is a component of the volatility skew (or smile) observed in options markets, where implied volatility varies with strike price. Understanding skewness helps in constructing strategies that exploit these variations.

Options Quote

Option quotes include: exercise price, contract, latest price, buy and sell price, buy and sell volume, trading volume, implied volatility, Greek value, etc.